Larger Latino Small Businesses are Applying for Credit Again

The proportion of credit applications from larger Latino-Owned Businesses (LOBs) increased relative to smaller businesses.

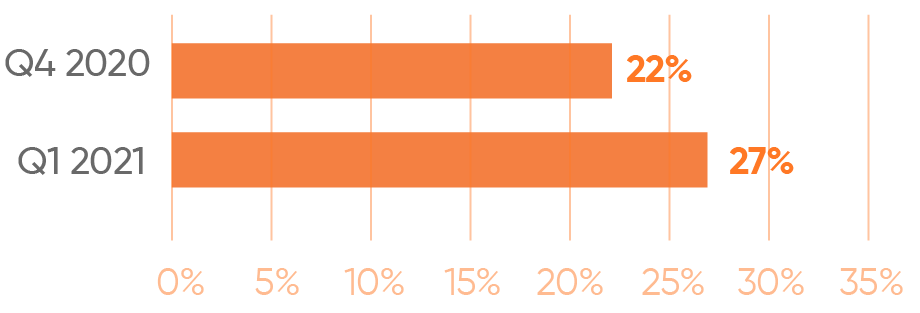

Credit applications from highest-revenue businesses (>$250K) is up from 22% in Q4 to 27% in Q1 Credit applications from mid-tier businesses (annual revenue $100K-$249K) shrank considerably from 32.2% to 26.9% quarter over quarter

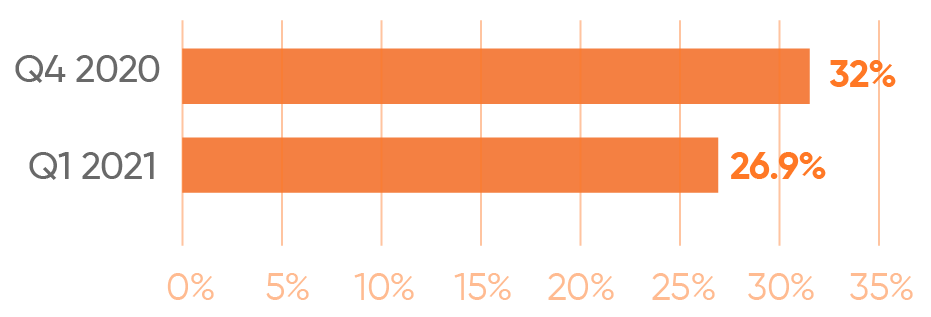

Credit applications from mid-tier businesses (annual revenue $100K-$249K) shrank considerably from 32.2% to 26.9% quarter over quarter